After decades of focus on export markets, UK customers are becoming more important than ever in the manufacturing supply chain, a trend that is increasing rapidly according to Tewkesbury-based industrial parts washing specialist MecWash.

Automotive, aerospace and fluid power are core sectors for MecWash, who supply customers all over the world. Even their UK customer base consists largely of companies with international operations serving worldwide markets. Against this truly global customer base, MecWash is now seeing an upsurge in orders led by a resurgent UK manufacturing sector.

John Pattison, managing director at MecWash, explains: “The global car industry trend is usually a much more relevant business indicator for us than the UK manufacturing sector. We are now seeing UK manufacturing as much busier than the general impression portrayed in the media.

“Brexit is undoubtedly a major factor, encouraging reshoring. Many businesses are keen to increase the UK percentage of their supply chain as sterling deteriorates and as the ‘buy British’ ethos strengthens.”

Reshoring, the process of bringing operations from other countries back home, has been advocated by many influential people for years. UK reshoring specifically has been growing in popularity throughout the last decade as labour costs in powerhouse economies such as China and Eastern Europe have increased (even before the post-Brexit vote Sterling decline) and greater emphasis is put on quality. It is also encouraged by easier communication, shorter lead times, reduced shipping costs and simply seeing it as the right thing to do to support the UK economy.

According to the EEF (Engineering Employers Federation) 2014 survey, a desire to improve quality, rather than rising wage costs overseas, lies behind the trend towards bringing production back to the UK. The EEF said the trend was set to continue, with 6 per cent saying they planned to “reshore” production in the following three years. The EEF also said the survey showed benefits being felt down the supply chain – with one in six in the survey saying they had reshored sourcing to a UK-based supplier.

This is certainly the experience at MecWash. One such example is Leicester Precision Components (LPC), who installed a second aqueous washing machine, a MecWash Midi, as part of a £2 million investment in its UK production facility.

LPC secured a substantial contract to produce volume precision machined parts for high-end automotive vehicles, previously manufactured in Hungary, and MecWash parts washing equipment was key to being able to successfully service this contract from the UK.

LPC sales manager, Robert Wortley, comments: “Our client needed to ensure we could consistently deliver parts that meet the high standards demanded by the automotive sector, so we turned to MecWash for assistance.

“Parts which were previously being made in Hungary were subsequently produced here in the UK which is great news for us, as well as the local and national economy. We commissioned the MecWash Midi after it was proven that it could remove metal particulates along with cutting fluid residues from the parts – exceeding stringent customer specifications.“ he added.

Automotive manufacturing growth in the UK is confirmed by the Automotive Council, a lobby group, who show that 44% of all parts used in cars are now manufactured in Britain, up from 35% in 2011.

Aerospace is a similar success story for UK manufacturing. UK aerospace output has grown by 39% since 2011, with annual turnover now reaching almost £32billion. The ADS Outlook Report in June 2017 is also very positive, showing the sector growing by 8% in the UK during 2016 and reporting that two thirds of UK aerospace accompanies expect growth of over 10% next year.

This is underpinned by findings of the Index, produced for the Chartered Institute of Procurement & Supply (CIPS) by Dun & Bradstreet economists, which shows that risks increase in long international supply chains. Notably, the Western Europe risk measure is the highest in the World following the Brexit vote and hence is a key factor in UK reshoring.

John Pattison confirms: “The UK’s decision to leave the European Union and the election of Donald Trump have illustrated a clear trend towards "localism" in the global economy, one that has been noticeable through our customer base. Our experience leaves us in no doubt that that international supply chain risk is set to increase further in 2018 and continue to drive reshoring.”

For MecWash, these trends mean a record order book and a very healthy outlook. Increased focus among manufacturers on quality and the requirement to develop new UK operations have resulted in a significant increase in demand for higher end parts washing solutions, particularly in the UK.

Albright International, a Hampshire-based DC contactors and disconnect switches manufacturer was outsourcing its component cleaning processes which was having an adverse impact on the lead times it could offer its customers.

A leading global supplier to industries including electric vehicles, telecommunication systems, welding machines, railway equipment and marine products, it turned to MecWash to provide a solution to bring its cleaning process in-house at its UK base.

Peter Lowry, senior supervisor at Albright International, said: “Our previous regime involved all of the copper parts we use in our components being sent to a sub-contractor before the brazing process was carried out. Parts would go out for bright acid dipping to ensure that the surface of each one was completely clean and ready for brazing.

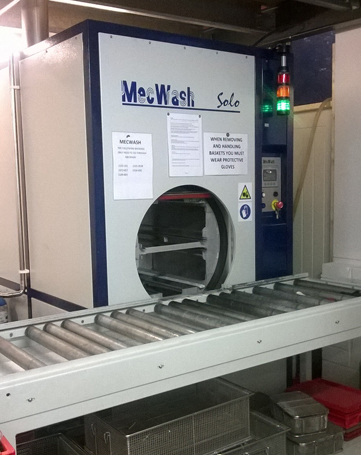

“However, this process typically took two to three days to complete and also meant an added cost for each of the components which we wanted to reduce so we looked to MecWash who recommended one of their Solo aqueous cleaning systems.

“Some machine brass parts also used to go for sub contract cleaning, but since the introduction of the Solo machine we are now able to clean more than 90% of our parts in-house and this means we have made a substantial saving on the costs of cleaning.”

He added: “We are delighted with the solution MecWash proposed and the Solo has proved to be perfect for our needs and, more importantly, those of our customers.”

MecWash and its customers certainly provide compelling evidence of a resurgent UK manufacturing economy that looks to be boosted by reshoring that is encouraged by Brexit.

John Pattison issues a note of warning however: “A recent survey (Nov 17) by the Chartered Institute of Procurement and Supply (CIPS) confirms that 63% of British businesses that use EU-based suppliers said they were looking for British replacements. That is great news for the UK.

“However in the same CIPS survey, 46% of European businesses said that they were expecting to reduce their use of British suppliers, because of Brexit. Reshoring works both ways, so UK manufacturing must continue to provide top quality and productivity if the tide is to continue flowing in our favour.” concludes John.